Mathematical Proof that National Debt and the Deficit are Necessary (and therefore not 'Evil')

Citizens Oversight (2013-03-08) Ray Lutz

This Page:

https://copswiki.org/Common/M1348Media Link:

http://youtu.be/Am0Na3lp-7c%20type%3d%22html%22More Info:

Budget And Taxation

Revised 2013-03-18

This analysis has a robust discussion on Facebook, click here to join the fray

The national economy, debts and deficits are largely totally misunderstood. People attempt to relate them to a family budget where you have to pay your bills and balance your budget. But the reality for the federal government is far different. Here, I will explain and "prove" that a balanced budget is not a reasonable goal, deficits are to be expected, and the national debt is largely not a concern.

The national economy is very complex. So we need to start with a simplified model and then gradually add complexity so you can hold the whole thing in your mind at one time.

We will initially consider a closed economy, one that has no trade deficits, no internal loans or debts -- transactions are all cash. There are two actors. The (federal) government, which by our constitution has the sole right to coin money, and the citizenry, who can trade with each other without limit. We will also ignore the Federal Reserve Bank for now, and assume that the government can create money when it needs it. The citizens are sufficient in number so they can provide almost anything in the economy that is needed, somewhat like a profile of our private sector. We will also assume the government must also fund certain activities, such as national defense, which the citizenry participate in providing and are paid to do so by the government.

Follow $100, closed economy.

First, let's consider $100, which is spent by the government to provide those services. To be simple, we will assume there is a flat tax rate of 30%, and taxes are levied instantly, and each transaction results in "income" that can be taxed.

On day 1, the government spends $100 to provide needed national defense services and the citizenry pays income taxes of 30% on that purchase. That leaves $70 circulating in the economy. In the next transaction $70 are spent and earned for services and products provided, and income taxes of 30% are paid on that leaving 0.7*70 = $49.

And the circulation continues. We can abbreviate the process in the following table:

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Taxes |

| |

|

0 |

0 |

|

| 0 |

100 |

-100.00 |

100.00 |

0.00 |

| 1 |

0 |

-70.00 |

70.00 |

30.00 |

| 2 |

0 |

-49.00 |

49.00 |

21.00 |

| 3 |

0 |

-34.30 |

34.30 |

14.70 |

| 4 |

0 |

-24.01 |

24.01 |

10.29 |

| 5 |

0 |

-16.81 |

16.81 |

7.20 |

| 6 |

0 |

-11.76 |

11.76 |

5.04 |

| 7 |

0 |

-8.24 |

8.24 |

3.53 |

| 8 |

0 |

-5.76 |

5.76 |

2.47 |

| 9 |

0 |

-4.04 |

4.04 |

1.73 |

| 10 |

0 |

-2.82 |

2.82 |

1.21 |

| 11 |

0 |

-1.98 |

1.98 |

0.85 |

| 12 |

0 |

-1.38 |

1.38 |

0.59 |

| 13 |

0 |

-0.97 |

0.97 |

0.42 |

| 14 |

0 |

-0.68 |

0.68 |

0.29 |

| 15 |

0 |

-0.47 |

0.47 |

0.20 |

| 16 |

0 |

-0.33 |

0.33 |

0.14 |

| 17 |

0 |

-0.23 |

0.23 |

0.10 |

| 18 |

0 |

-0.16 |

0.16 |

0.07 |

| 19 |

0 |

-0.11 |

0.11 |

0.05 |

| 20 |

0 |

-0.08 |

0.08 |

0.03 |

| 21 |

0 |

-0.06 |

0.06 |

0.02 |

| 22 |

0 |

-0.04 |

0.04 |

0.02 |

| 23 |

0 |

-0.03 |

0.03 |

0.01 |

| 24 |

0 |

-0.02 |

0.02 |

0.01 |

| 25 |

0 |

-0.01 |

0.01 |

0.01 |

Of course, mathematically speaking, it is impossible to ever get all of it back because even if there is only a tiny bit left, taxing at 30% leaves an even tinier portion, etc., even though it is much less than a penny after 25 cycles or so. But if you spend a lot more, like a trillion instead of $100, then the portion that is less than a penny in this example is still significant. If you carry unlimited fractional amounts, you can never get it down to zero. Let me say that again. YOU CAN NEVER TAX IT ALL BACK! That's simply a mathematical fact.

Constant spending in a closed economy with constant average tax rate

Let's do this again but this time, let's have the govt consistently spent $100 in each period. I added another column, Tax Rate, so we can experiment with changing the tax rate.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100 |

-100.00 |

100.00 |

30% |

0.00 |

|

| 1 |

100 |

-170.00 |

170.00 |

30% |

30.00 |

70.00% |

| 2 |

100 |

-219.00 |

219.00 |

30% |

51.00 |

49.00% |

| 3 |

100 |

-253.30 |

253.30 |

30% |

65.70 |

34.30% |

| 4 |

100 |

-277.31 |

277.31 |

30% |

75.99 |

24.01% |

| 5 |

100 |

-294.12 |

294.12 |

30% |

83.19 |

16.81% |

| 6 |

100 |

-305.88 |

305.88 |

30% |

88.24 |

11.76% |

| 7 |

100 |

-314.12 |

314.12 |

30% |

91.76 |

8.24% |

| 8 |

100 |

-319.88 |

319.88 |

30% |

94.24 |

5.76% |

| 9 |

100 |

-323.92 |

323.92 |

30% |

95.96 |

4.04% |

| 10 |

100 |

-326.74 |

326.74 |

30% |

97.18 |

2.82% |

| 11 |

100 |

-328.72 |

328.72 |

30% |

98.02 |

1.98% |

| 12 |

100 |

-330.10 |

330.10 |

30% |

98.62 |

1.38% |

| 13 |

100 |

-331.07 |

331.07 |

30% |

99.03 |

0.97% |

| 14 |

100 |

-331.75 |

331.75 |

30% |

99.32 |

0.68% |

| 15 |

100 |

-332.23 |

332.23 |

30% |

99.53 |

0.47% |

| 16 |

100 |

-332.56 |

332.56 |

30% |

99.67 |

0.33% |

| 17 |

100 |

-332.79 |

332.79 |

30% |

99.77 |

0.23% |

| 18 |

100 |

-332.95 |

332.95 |

30% |

99.84 |

0.16% |

| 19 |

100 |

-333.07 |

333.07 |

30% |

99.89 |

0.11% |

| 20 |

100 |

-333.15 |

333.15 |

30% |

99.92 |

0.08% |

| 21 |

100 |

-333.20 |

333.20 |

30% |

99.94 |

0.06% |

| 22 |

100 |

-333.24 |

333.24 |

30% |

99.96 |

0.04% |

| 23 |

100 |

-333.27 |

333.27 |

30% |

99.97 |

0.03% |

| 24 |

100 |

-333.29 |

333.29 |

30% |

99.98 |

0.02% |

| 25 |

100 |

-333.30 |

333.30 |

30% |

99.99 |

0.01% |

After a number of periods, the economic situation will stabilize, and almost will balance, but will never do so, just as in the case of a single spending period. The total govt debt equals the amount of money in circulation, which is (nearly) the amount the govt spends in any period divided by the tax rate. Thus, $100/.30 = $333.33. Please note that if we consider all money entered into the economy as the govt debt, then it is impossible to "pay off the debt," or we will have no money at all.

Stimulus: Budget can balance if spending goes up then down

If spending increases, and then returns to a stable figure, the budget can just barely balance. Note that long term, the amount of money in the economy is based on the average tax rate, but the short-term stimulus does help the economy balance IF it returns to a set value.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100 |

-100.00 |

100.00 |

30% |

0.00 |

|

| 1 |

100 |

-170.00 |

170.00 |

30% |

30.00 |

70.00% |

| 2 |

100 |

-219.00 |

219.00 |

30% |

51.00 |

49.00% |

| 3 |

100 |

-253.30 |

253.30 |

30% |

65.70 |

34.30% |

| 4 |

100 |

-277.31 |

277.31 |

30% |

75.99 |

24.01% |

| 5 |

100 |

-294.12 |

294.12 |

30% |

83.19 |

16.81% |

| 6 |

100 |

-305.88 |

305.88 |

30% |

88.24 |

11.76% |

| 7 |

100 |

-314.12 |

314.12 |

30% |

91.76 |

8.24% |

| 8 |

100 |

-319.88 |

319.88 |

30% |

94.24 |

5.76% |

| 9 |

100 |

-323.92 |

323.92 |

30% |

95.96 |

4.04% |

| 10 |

110 |

-336.74 |

336.74 |

30% |

97.18 |

11.66% |

| 11 |

100 |

-335.72 |

335.72 |

30% |

101.02 |

-1.02% |

| 12 |

100 |

-335.00 |

335.00 |

30% |

100.72 |

-0.72% |

| 13 |

100 |

-334.50 |

334.50 |

30% |

100.50 |

-0.50% |

| 14 |

100 |

-334.15 |

334.15 |

30% |

100.35 |

-0.35% |

| 15 |

100 |

-333.91 |

333.91 |

30% |

100.25 |

-0.25% |

| 16 |

100 |

-333.73 |

333.73 |

30% |

100.17 |

-0.17% |

| 17 |

100 |

-333.61 |

333.61 |

30% |

100.12 |

-0.12% |

| 18 |

100 |

-333.53 |

333.53 |

30% |

100.08 |

-0.08% |

| 19 |

100 |

-333.47 |

333.47 |

30% |

100.06 |

-0.06% |

| 20 |

100 |

-333.43 |

333.43 |

30% |

100.04 |

-0.04% |

| 21 |

100 |

-333.40 |

333.40 |

30% |

100.03 |

-0.03% |

| 22 |

100 |

-333.38 |

333.38 |

30% |

100.02 |

-0.02% |

| 23 |

100 |

-333.37 |

333.37 |

30% |

100.01 |

-0.01% |

| 24 |

100 |

-333.36 |

333.36 |

30% |

100.01 |

-0.01% |

| 25 |

100 |

-333.35 |

333.35 |

30% |

100.01 |

-0.01% |

Notice above that in period 10, govt spending increased by 10%, then went back to the set value. As a result, there is a bit more money in circulation, which allows the budget to be in slight surplus for a while. When the system stabilizes, govt debt is the same.

Thus, the idea that a balanced budget is "good" is really immaterial in this case because the overall govt debt is the same. The only way we see a surplus is because there is a big additional deficit in the year of increased spending.

NOTICE THAT LONG TERM, the govt debt must equal spending divided by the average tax rate, and the deficit will follow to make it so.

Double spending, Tax rate the same

It turns out that even if spending is doubled, if it is consistent, the deficit will approach (but never reach) zero. But the amount of money in circulation doubles, which pumps up the economy.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

200 |

-200.00 |

200.00 |

30% |

0.00 |

|

| 1 |

200 |

-340.00 |

340.00 |

30% |

60.00 |

70.00% |

| 2 |

200 |

-438.00 |

438.00 |

30% |

102.00 |

49.00% |

| 3 |

200 |

-506.60 |

506.60 |

30% |

131.40 |

34.30% |

| 4 |

200 |

-554.62 |

554.62 |

30% |

151.98 |

24.01% |

| 5 |

200 |

-588.23 |

588.23 |

30% |

166.39 |

16.81% |

| 6 |

200 |

-611.76 |

611.76 |

30% |

176.47 |

11.76% |

| 7 |

200 |

-628.23 |

628.23 |

30% |

183.53 |

8.24% |

| 8 |

200 |

-639.76 |

639.76 |

30% |

188.47 |

5.76% |

| 9 |

200 |

-647.83 |

647.83 |

30% |

191.93 |

4.04% |

| 10 |

200 |

-653.48 |

653.48 |

30% |

194.35 |

2.82% |

| 11 |

200 |

-657.44 |

657.44 |

30% |

196.05 |

1.98% |

| 12 |

200 |

-660.21 |

660.21 |

30% |

197.23 |

1.38% |

| 13 |

200 |

-662.15 |

662.15 |

30% |

198.06 |

0.97% |

| 14 |

200 |

-663.50 |

663.50 |

30% |

198.64 |

0.68% |

| 15 |

200 |

-664.45 |

664.45 |

30% |

199.05 |

0.47% |

| 16 |

200 |

-665.12 |

665.12 |

30% |

199.34 |

0.33% |

| 17 |

200 |

-665.58 |

665.58 |

30% |

199.53 |

0.23% |

| 18 |

200 |

-665.91 |

665.91 |

30% |

199.67 |

0.16% |

| 19 |

200 |

-666.13 |

666.13 |

30% |

199.77 |

0.11% |

| 20 |

200 |

-666.29 |

666.29 |

30% |

199.84 |

0.08% |

| 21 |

200 |

-666.41 |

666.41 |

30% |

199.89 |

0.06% |

| 22 |

200 |

-666.48 |

666.48 |

30% |

199.92 |

0.04% |

| 23 |

200 |

-666.54 |

666.54 |

30% |

199.95 |

0.03% |

| 24 |

200 |

-666.58 |

666.58 |

30% |

199.96 |

0.02% |

| 25 |

200 |

-666.60 |

666.60 |

30% |

199.97 |

0.01% |

Half the tax rate, standard spending

Let's go back to fixed $100 spending per period and decrease the tax rate.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100 |

-100.00 |

100.00 |

15% |

0.00 |

|

| 1 |

100 |

-185.00 |

185.00 |

15% |

15.00 |

85.00% |

| 2 |

100 |

-257.25 |

257.25 |

15% |

27.75 |

72.25% |

| 3 |

100 |

-318.66 |

318.66 |

15% |

38.59 |

61.41% |

| 4 |

100 |

-370.86 |

370.86 |

15% |

47.80 |

52.20% |

| 5 |

100 |

-415.23 |

415.23 |

15% |

55.63 |

44.37% |

| 6 |

100 |

-452.95 |

452.95 |

15% |

62.29 |

37.71% |

| 7 |

100 |

-485.01 |

485.01 |

15% |

67.94 |

32.06% |

| 8 |

100 |

-512.26 |

512.26 |

15% |

72.75 |

27.25% |

| 9 |

100 |

-535.42 |

535.42 |

15% |

76.84 |

23.16% |

| 10 |

100 |

-555.10 |

555.10 |

15% |

80.31 |

19.69% |

| 11 |

100 |

-571.84 |

571.84 |

15% |

83.27 |

16.73% |

| 12 |

100 |

-586.06 |

586.06 |

15% |

85.78 |

14.22% |

| 13 |

100 |

-598.15 |

598.15 |

15% |

87.91 |

12.09% |

| 14 |

100 |

-608.43 |

608.43 |

15% |

89.72 |

10.28% |

| 15 |

100 |

-617.17 |

617.17 |

15% |

91.26 |

8.74% |

| 16 |

100 |

-624.59 |

624.59 |

15% |

92.57 |

7.43% |

| 17 |

100 |

-630.90 |

630.90 |

15% |

93.69 |

6.31% |

| 18 |

100 |

-636.27 |

636.27 |

15% |

94.64 |

5.36% |

| 19 |

100 |

-640.83 |

640.83 |

15% |

95.44 |

4.56% |

| 20 |

100 |

-644.70 |

644.70 |

15% |

96.12 |

3.88% |

| 21 |

100 |

-648.00 |

648.00 |

15% |

96.71 |

3.29% |

| 22 |

100 |

-650.80 |

650.80 |

15% |

97.20 |

2.80% |

| 23 |

100 |

-653.18 |

653.18 |

15% |

97.62 |

2.38% |

| 24 |

100 |

-655.20 |

655.20 |

15% |

97.98 |

2.02% |

| 25 |

100 |

-656.92 |

656.92 |

15% |

98.28 |

1.72% |

In this case, it takes much longer to stabilize. There is still 2x funds circulating, comparable to doubling spending, but the deficit is much larger. If spending is fixed, the system will eventually stabilize at "nearly balanced" no matter what the spending level or tax rate, but it takes LONGER to stabilize if spending is too low or tax rate is too low.

Thus, if you care about the deficit, you will opt for increased spending rather than lower taxes, and you must expect that the budget will never quite balance, and this is if there is NO EXPANSION, which is not realistic.

Expanding Economy

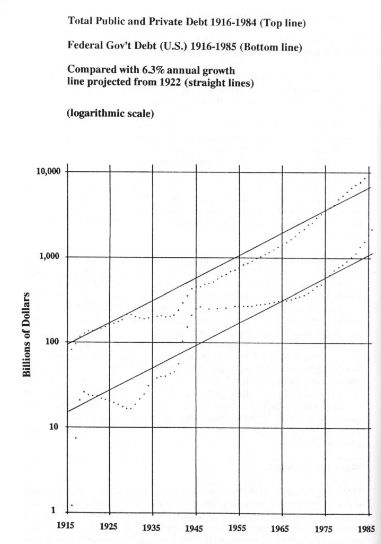

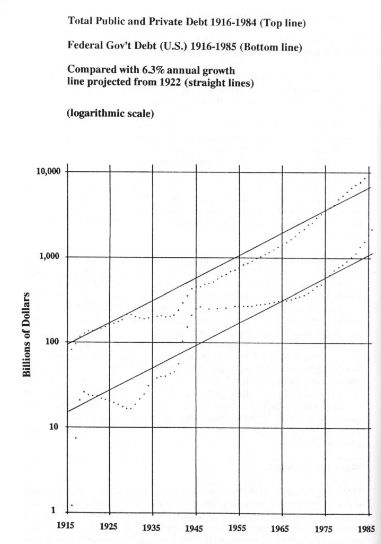

As the population increases, there will be a requirement for an expanding economy. On average, the federal debt increases at about 6.3% a year.

Plot of total public and private debt with federal debt 1915 to 1985.jpg:

Now we will add some realistic changes to the economy. First, we will assume that the economy is expanding, and spending increases at a steady rate. We will set the expansion at a set 3% per period.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100.00 |

-100.00 |

100.00 |

30% |

0.00 |

|

| 1 |

103.00 |

-173.00 |

173.00 |

30% |

30.00 |

70.87% |

| 2 |

106.09 |

-227.19 |

227.19 |

30% |

51.90 |

51.08% |

| 3 |

109.27 |

-268.31 |

268.31 |

30% |

68.16 |

37.63% |

| 4 |

112.55 |

-300.36 |

300.36 |

30% |

80.49 |

28.48% |

| 5 |

115.93 |

-326.18 |

326.18 |

30% |

90.11 |

22.27% |

| 6 |

119.41 |

-347.73 |

347.73 |

30% |

97.85 |

18.05% |

| 7 |

122.99 |

-366.40 |

366.40 |

30% |

104.32 |

15.18% |

| 8 |

126.68 |

-383.16 |

383.16 |

30% |

109.92 |

13.23% |

| 9 |

130.48 |

-398.69 |

398.69 |

30% |

114.95 |

11.90% |

| 10 |

134.39 |

-413.47 |

413.47 |

30% |

119.61 |

11.00% |

| 11 |

138.42 |

-427.85 |

427.85 |

30% |

124.04 |

10.39% |

| 12 |

142.58 |

-442.07 |

442.07 |

30% |

128.36 |

9.97% |

| 13 |

146.85 |

-456.31 |

456.31 |

30% |

132.62 |

9.69% |

| 14 |

151.26 |

-470.67 |

470.67 |

30% |

136.89 |

9.50% |

| 15 |

155.80 |

-485.27 |

485.27 |

30% |

141.20 |

9.37% |

| 16 |

160.47 |

-500.16 |

500.16 |

30% |

145.58 |

9.28% |

| 17 |

165.28 |

-515.40 |

515.40 |

30% |

150.05 |

9.22% |

| 18 |

170.24 |

-531.02 |

531.02 |

30% |

154.62 |

9.18% |

| 19 |

175.35 |

-547.06 |

547.06 |

30% |

159.31 |

9.15% |

| 20 |

180.61 |

-563.56 |

563.56 |

30% |

164.12 |

9.13% |

| 21 |

186.03 |

-580.52 |

580.52 |

30% |

169.07 |

9.12% |

| 22 |

191.61 |

-597.97 |

597.97 |

30% |

174.16 |

9.11% |

| 23 |

197.36 |

-615.94 |

615.94 |

30% |

179.39 |

9.10% |

| 24 |

203.28 |

-634.44 |

634.44 |

30% |

184.78 |

9.10% |

| 25 |

209.38 |

-653.48 |

653.48 |

30% |

190.33 |

9.10% |

You will note that the budget stabilizes with a consistent deficit. There is no way to fix this if the economy is expanding, even if tax rates are increased. Let's double the tax rates to try to get rid of the deficit.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100.00 |

-100.00 |

100.00 |

60% |

0.00 |

|

| 1 |

103.00 |

-143.00 |

143.00 |

60% |

60.00 |

41.75% |

| 2 |

106.09 |

-163.29 |

163.29 |

60% |

85.80 |

19.13% |

| 3 |

109.27 |

-174.59 |

174.59 |

60% |

97.97 |

10.34% |

| 4 |

112.55 |

-182.39 |

182.39 |

60% |

104.75 |

6.93% |

| 5 |

115.93 |

-188.88 |

188.88 |

60% |

109.43 |

5.60% |

| 6 |

119.41 |

-194.96 |

194.96 |

60% |

113.33 |

5.09% |

| 7 |

122.99 |

-200.97 |

200.97 |

60% |

116.97 |

4.89% |

| 8 |

126.68 |

-207.07 |

207.07 |

60% |

120.58 |

4.81% |

| 9 |

130.48 |

-213.30 |

213.30 |

60% |

124.24 |

4.78% |

| 10 |

134.39 |

-219.71 |

219.71 |

60% |

127.98 |

4.77% |

| 11 |

138.42 |

-226.31 |

226.31 |

60% |

131.83 |

4.76% |

| 12 |

142.58 |

-233.10 |

233.10 |

60% |

135.79 |

4.76% |

| 13 |

146.85 |

-240.09 |

240.09 |

60% |

139.86 |

4.76% |

| 14 |

151.26 |

-247.30 |

247.30 |

60% |

144.06 |

4.76% |

| 15 |

155.80 |

-254.72 |

254.72 |

60% |

148.38 |

4.76% |

| 16 |

160.47 |

-262.36 |

262.36 |

60% |

152.83 |

4.76% |

| 17 |

165.28 |

-270.23 |

270.23 |

60% |

157.41 |

4.76% |

| 18 |

170.24 |

-278.33 |

278.33 |

60% |

162.14 |

4.76% |

| 19 |

175.35 |

-286.68 |

286.68 |

60% |

167.00 |

4.76% |

| 20 |

180.61 |

-295.28 |

295.28 |

60% |

172.01 |

4.76% |

| 21 |

186.03 |

-304.14 |

304.14 |

60% |

177.17 |

4.76% |

| 22 |

191.61 |

-313.27 |

313.27 |

60% |

182.49 |

4.76% |

| 23 |

197.36 |

-322.67 |

322.67 |

60% |

187.96 |

4.76% |

| 24 |

203.28 |

-332.35 |

332.35 |

60% |

193.60 |

4.76% |

| 25 |

209.38 |

-342.32 |

342.32 |

60% |

199.41 |

4.76% |

Thus, even with incredible 60% tax rates, the deficit continues to persist in an expanding economy. This is also the case with a TRADE DEFICIT, and the table will look about the same with a trade deficit as with an expanding economy. Note, however, that with the double tax rates, it cuts the amount of money in the economy by a factor of two.

Just for fun, let's reduce the tax rate to the lower 15% rate to see what happens.

| Step |

Govt Spends |

Govt Bank |

$ in Circulation |

Avg Tax Rate |

Tax Revenue |

Budget Deficit |

| |

|

0 |

0 |

|

|

| 0 |

100.00 |

-100.00 |

100.00 |

15% |

0.00 |

|

| 1 |

103.00 |

-188.00 |

188.00 |

15% |

15.00 |

85.44% |

| 2 |

106.09 |

-265.89 |

265.89 |

15% |

28.20 |

73.42% |

| 3 |

109.27 |

-335.28 |

335.28 |

15% |

39.88 |

63.50% |

| 4 |

112.55 |

-397.54 |

397.54 |

15% |

50.29 |

55.32% |

| 5 |

115.93 |

-453.83 |

453.83 |

15% |

59.63 |

48.56% |

| 6 |

119.41 |

-505.16 |

505.16 |

15% |

68.08 |

42.99% |

| 7 |

122.99 |

-552.38 |

552.38 |

15% |

75.77 |

38.39% |

| 8 |

126.68 |

-596.20 |

596.20 |

15% |

82.86 |

34.59% |

| 9 |

130.48 |

-637.25 |

637.25 |

15% |

89.43 |

31.46% |

| 10 |

134.39 |

-676.05 |

676.05 |

15% |

95.59 |

28.87% |

| 11 |

138.42 |

-713.07 |

713.07 |

15% |

101.41 |

26.74% |

| 12 |

142.58 |

-748.68 |

748.68 |

15% |

106.96 |

24.98% |

| 13 |

146.85 |

-783.23 |

783.23 |

15% |

112.30 |

23.53% |

| 14 |

151.26 |

-817.01 |

817.01 |

15% |

117.49 |

22.33% |

| 15 |

155.80 |

-850.25 |

850.25 |

15% |

122.55 |

21.34% |

| 16 |

160.47 |

-883.19 |

883.19 |

15% |

127.54 |

20.52% |

| 17 |

165.28 |

-915.99 |

915.99 |

15% |

132.48 |

19.85% |

| 18 |

170.24 |

-948.84 |

948.84 |

15% |

137.40 |

19.29% |

| 19 |

175.35 |

-981.86 |

981.86 |

15% |

142.33 |

18.83% |

| 20 |

180.61 |

-1015.19 |

1015.19 |

15% |

147.28 |

18.46% |

| 21 |

186.03 |

-1048.94 |

1048.94 |

15% |

152.28 |

18.14% |

| 22 |

191.61 |

-1083.21 |

1083.21 |

15% |

157.34 |

17.88% |

| 23 |

197.36 |

-1118.09 |

1118.09 |

15% |

162.48 |

17.67% |

| 24 |

203.28 |

-1153.66 |

1153.66 |

15% |

167.71 |

17.50% |

| 25 |

209.38 |

-1189.99 |

1189.99 |

15% |

173.05 |

17.35% |

You can see that the amount of money in the economy is increased, as is the total govt debt, but it takes much longer for the economy to stabilize.

Lowering tax rates pumps up the amount of money in circulation but winds up with a higher deficit because it takes much longer to stabilize.

Effect of the Fractional Reserve Banking System

The fractional reserve banking system allows banks to lend more money than they have as deposits. Thus, if they have $100 deposited, then they can loan x times that amount, depending on the required reserve amount. Assuming a 10% reserve is required, they could lend $1000, and thereby magically create $900 of "IOU Money" based on the promise of the borrower. That 'new money' circulates through the economy and some people will earn that money as their income, and therefore they pay income taxes, and this can contribute to the overall tax revenue. So indeed, whenever the reserve amount is reduced and there is new "IOU money" created, then it can appear that much more money exists in the economy than was created by the govt. However, as those loans are repaid, the money "disappears." The banks can then make new loans up to the reserve limit, and the IOU money is recreated. So in a stable economy, the net result of the fractional reserve system is zero, in terms of its contribution to the ability of the govt to recover any new money spent.

If reserve requirements are decreased, say from 10% to 4%, this can provide what appears to be more money in the economy, and it may be possible to balance the budget for a short time using this "IOU money" to fund it. If you reduce it later, say from 4% to 10% reserve requirement, this will reduce the amount of IOU money, and the economy must go into a larger deficit situation.

In the financial crash of 2008, the financial industry had pushed "subprime" loans, and then they packaged those up into bundles that could be traded on the stock market. The reality is that real estate is not very liquid, and so it it is not compatible with the computerized trading schemes used in the stock market today. But these bundles are compatible. Speculation pushed home prices up to unbelievable levels because of the demand of subprime loans the the traders that were eager to package them up. Eventually, the bubble did burst, and it was discovered that many of the loans would never be paid off. When that happens, the IOU money instantly disappears, and thus the crash and recession.

The bottom line of the Fractional Reserve System is that it cannot help to balance the budget for any length of time UNLESS the total private debt is going up at the same time either through a steady reduction in the reserve requirement or far more loans made that will may look good at first but probably will not be paid off. So for purposes of considering the balanced budget, we have to ignore the impact of the fractional reserve system.

Sequestration

Sequestration and other austerity measures are absolutely the wrong thing to do and will not stimulate the economy or help the deficit situation over the long term. Cutting government spending will not move us toward a balanced budget as this will remove money from the economy at exactly the time when we need more spending. The mindset that the federal govt should balance the budget will drive the economy toward recession, and a "balanced approach" means that we run a deficit of about 7% of GDP.

Federal Reserve Bank

Unlike the simplified case described above, and although the U.S. Congress is the only entity allowed to "coin" money and put it into circulation, that responsibility has been delegated to a private bank, the Federal Reserve Bank. Realise that this bank is not an governmental institution, it is a private bank. It is no more "federal" than is "Federal Express." But despite that concern, they have been given the right to create new money, and then "loan" it to the federal government, with interest. Of course, as we have shown, there is no magical source for that interest, because once you spend money into the economy, you can only get back what you have spent, and no more. There is no magical source of money in the economy except for this authority to print new money, delegated to the Federal Reserve Bank, and there is absolutely no way to get the interest they expect to be paid, except with newly printed money, thus putting us in an eternal borrowing cycle. These interest charges should be banned, and the entire interest earned over the entirety of the history of the Federal Reserve Bank should be instantly forgiven.

Quantitative Easing

After the Bush crash of 2008, an immense quatity of money disappeared due to bad debt. When a bank makes a loan under the fractional reserve system, new money is "created" when the loan is made, based on the inverse of the fractional reserve requirement. At this juncture, I believe the reserve requirement is 4%. Thus, if a bank has $4, then can loan $100, resulting in $96 of new money. To the extent the economy is based on borrowed funds, such as for mortgages, this represents a significant amount of IOU money circulating. Once it is created in this fashion, the amount of money is fixed based on the reserve requirement and the amount of non-IOU money on hand. At a steady-state, this does not permanently add or reduce the federal deficit.

Let's take an example. Assume Fred wants to buy a house and he saves up earnings for a 20% down payment, and then purchases a house with an 80% loan. The 80% is IOU money, which only 4% of real money in the bank to offset. The money is transferred to the seller, Sally. Sally pays off her remaining debt on her loan, which causes the IOU money to disappear, but will free up some reserve amount so that same IOU money can be loaned to another mortgage holder, in this case, it might even be Fred. The net result is that the amount of IOU money in circulation remains the same, as long as there is no bad debt.

In 2008, the crash can be traced back, in a large part, to a desire to trade real estate in speculative markets, and an immense number of loans were made to provide the fodder for this mill. When even a few of these loan holders defaulted on their loans, the IOU money previously in circulation suddenly disappears. As more and more loan holders suffered the same fate, the raw amount of money in the system crunched, causing the crash.

Those in charge of trying to stabilize our monetary system realized there was, as a result, a severe shortage of money in the system. "Quantitative Easing" was a program to add more money to the system by having the federal government pay off govt bonds and thereby add money into the system. Other "Stimulus" programs, such as checks to taxpayers and the reduction of the Social Security and Medicare payments by workers was perhaps a better way to increase the amount of money in the system.

Tax gives money its value

If you had no tax, and if the govt continued to spend (by printing new money), then the value of money would decline (rampant inflation) constantly. This is very inconvenient for consumers to try to track as prices would have to constantly be adjusted. But the decrease in value of money acts like a tax, which is uniformly applied, based on how much money you are holding. Even criminals would have to pay, and there are no forms to fill out. But it is very inconvenient.

To make sure money maintains a relatively even value, we have to remove money from the system at nearly the same rate as the amount that is spent, minus LOSSES. Thus, taxation is required to make sure money maintains a steady value.

Any % tax rate will eventually recover the money which is spent, and no % tax rate can get more out than is consistently spent. Lower tax rates keep money circulating longer and will maintain a larger amount of money in circulation. Higher tax rates recover the money from the economy more rapidly, and reduce money in circulation. Neither one is directly related to the deficit. Deficits are caused by LOSSES in the system.

Similarly, spending rates by the government have nothing to do with the deficit. Higher rates of spending do not result in higher deficits nor does lower spending result in lower deficits. As long as a % tax rate is imposed, eventually nearly all the money is recovered (minus losses).

In essence, there is ALWAYS a balanced budget, as long as losses are included. The actual equation is this one:

- Revenue = Spending - Losses

Revenue, is what is recovered in taxes, and spending is what is spent. Many in the federal government like to pretend that there is no loss term, and thus what they call a "balanced Budget." Both parties tend to misunderstand this. Democrats tend to teach that higher-taxes on the wealthy will offset higher spending on social programs. Republicans tend to teach that lower taxes will encourage the economy and result in a balance budget. Both ideas are half true and half false.

As long as there are consistent tax rates, the government can pretty much spend as much as it needs to. At first, higher spending will result in deficits, but will put more money in circulation, resulting in deficits in the first few years, but then stabilizing with more money in circulation. But you never get to balance the budget if you have losses. With relatively high taxes, money is taken out of circulation faster, and there is less chance for losses.

If you reduce spending and reduce taxes, as the republicans want to generally do, then you keep the money circulating longer, but less is in circulation. Losses may be about the same between the two scenarios.

Avoiding Losses.

Losses from the system are:

- Money not stored in a bank (say in an underground vault) and forgotten.

- Any trade deficit, including money spent in a foreign nation by the US

- Money stored in an offshore bank.

- Interest paid to the federal reserve

- etc.

The government only gets to directly control the first spend. Spending on infrastructure (esp. if it is truly beneficial to those in the economy) is money that will generally stay in the economy. If the government spends money on say a bridge, and buys it from China to save money, there will be large losses due to the trade deficit.

Trade deficits are partially made up for by international money markets, as these are theoretically able to allow the various monetary systems to restabilize to account for the losses. If we had sustained trade surpluses, in theory we could sustain extended budget surpluses.

But in general, if in one period you actually can manage a surplus, a recession will follow unless there are measures taken to provide much more money into the system.

The national Debt

The national debt is only the sum of all the deficits, and as may understand at this point, there is actually no way to "pay off" the national debt, and if we tried to actually do it by heavily taxing, then there would be no money left at all. The national debt does not cause bankruptcy, is not handed down to our children to pay off etc. etc. All that is hype used typically to either raise taxes or reduce spending.

CONCLUSION

A balanced budget is only possible if you have steady and somewhat declining economy. The principles of austerity being promoting by many governments so as to try to achieve a balanced budget can only be achieved with a steady or declining budget. An expanding economy REQUIRES a deficit, no matter what level of taxation you use. Similarly, if you have a TRADE DEFICIT, you will wind up with a situation similar to steady expansion.

Furthermore, in the U.S., the government has delegated the creation of new money to the Federal Reserve Bank, which loans the money to the govt with interest. As you can see, there is no way that the overall debt can ever be paid off, and there is no source for the interest, and it will simply add the the overall govt debt.

This debt is meaningless, will never be paid off, is not shouldered by our children, etc. And it does not mean that "we are broke." Anyone who says that is trying to fool you.

There are two ways to increase the amount of money in circulation, cutting tax rates or increasing spending. Both have the same effect if allowed to stabilize. But higher spending with modest tax rates results in lower deficits faster.

Now we will add some realistic changes to the economy. First, we will assume that the economy is expanding, and spending increases at a steady rate. We will set the expansion at a set 3% per period.

Now we will add some realistic changes to the economy. First, we will assume that the economy is expanding, and spending increases at a steady rate. We will set the expansion at a set 3% per period.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors.