RSG Notes on Hotel Bristol Stationery

Citizens Oversight (2013-03-26) Michael Peevey, Stephen Pickett This Page: https://copswiki.org/Common/M1568More Info: California Public Utilities Commission, Energy Policy, Shutdown Diablo, Shut San Onofre, Stop The Unfair Settlement

NEWS RELEASE – FOR IMMEDIATE RELEASE

CITIZENS OVERSIGHT RELEASES SECRET “BRISTOL HOTEL” RSG NOTES OUTLINING SAN ONOFRE SETTLEMENT

Notes were made during a meeting with ex-CPUC President Michael Peevey and SCE General Counsel Stephen Pickett, March 26, 2013 in Warsaw Poland

Notes document a startling disregard for the public process and illustrates CPUC corruption

SAN DIEGO (April 11, 2015) – Citizens Oversight yesterday gained access to the now infamous “RSG Notes on Bristol Hotel Stationery” mentioned in the list of items confiscated from Michael Peevey's home by the state Attorney General under felony search warrants. The meeting was finally disclosed by SCE in a late-filed notice of ex parte communication on February 9, 2015, nearly three years after the fact. These notes define – in startling detail – the basic settlement deal which was to eventually be disclosed by the utilities and a number of “settling parties” – ORA and TURN – who were involved in secret negotiations for nearly a year, but which resulted in a settlement deal which was largely what Peevey and Pickett had inked a year earlier. “This is extremely damning evidence that the entire public process of the San Onofre investigation was a sham, designed to scuttle the real investigation and result in the agreement struck in Warsaw, while conducting courtroom proceedings all just for show,” said Ray Lutz of Citizens Oversight. “Isn't it now clear that the settlement deal was fraudulent and should be restarted? At a minimum, we need to have an honest review of what went wrong and create a lessons-learned document so this never happens again.” These notes are pretty terse and cryptic. You won't understand them unless you are familiar with the case. But without trying to learn every nuance, you can see that Peevey and Pickett had reached a deal on many issues, resulting in the $3.3 billion settlement proposal, long before the plant had been officially shut down, and in the middle of the on-going public process, which was all but a sham. The note itself talks of shutting down the OII investigation. See the comparison below of the original position in the Warsaw Note, the initial settlement, and the approved settlement, along with our analysis.- Hotel_Bristol_Notes.pdf: PDF of RSG Notes on Hotel Bristol Stationery

- Web version of this press release: http://www.copswiki.org/Common/M1568

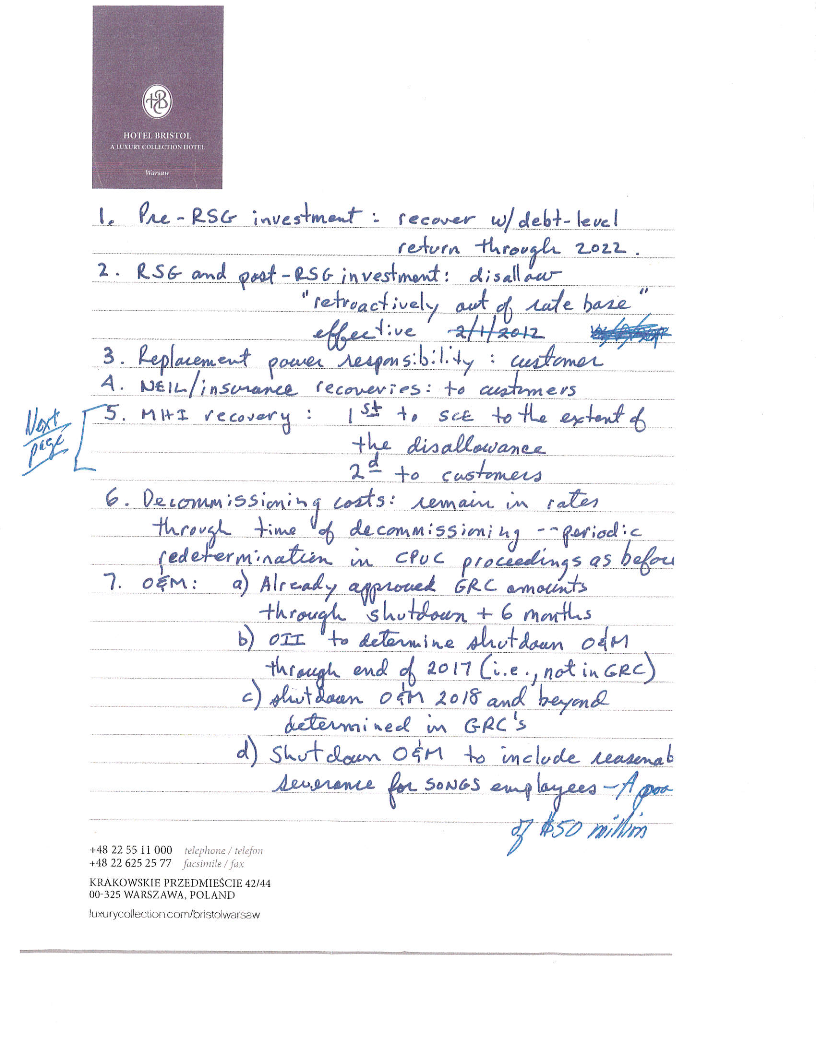

Hotel Bristol Notes, Page 1:

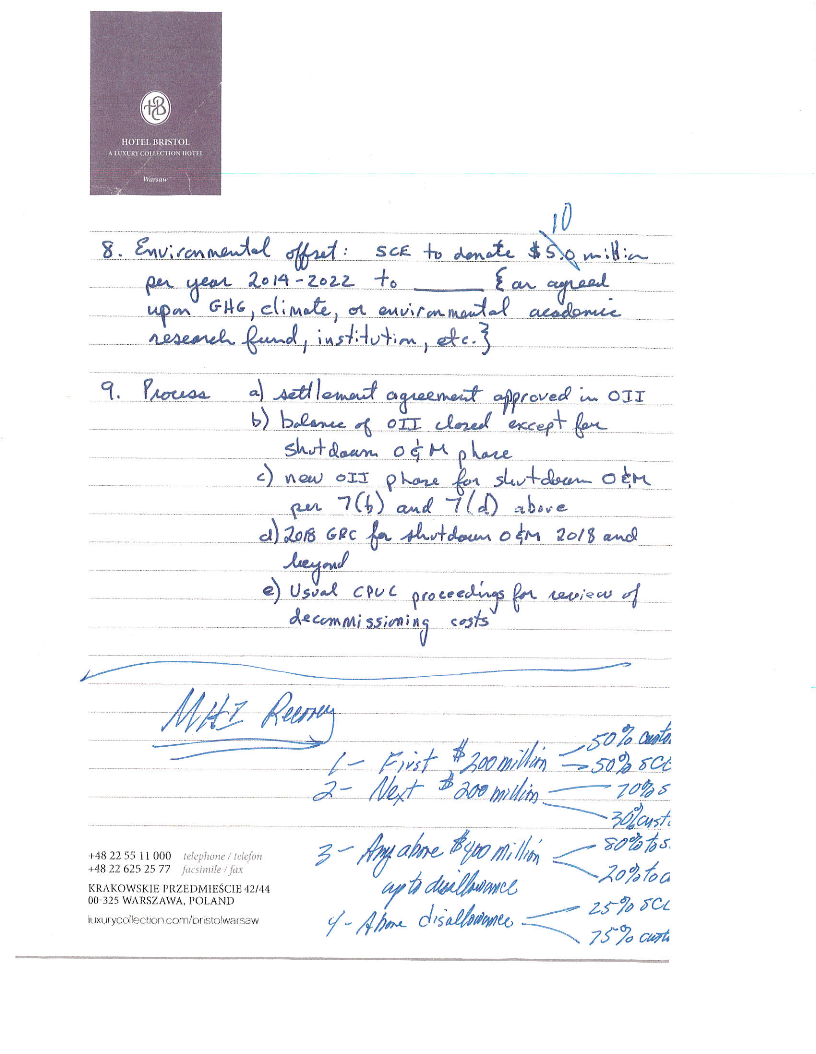

Hotel Bristol Notes, Page 2:

Analysis by Citizens Oversight:

We provide the following comparison between the Warsaw Notes, the initial settlement, as proposed fait accompli at the March 26, 2014 settlement meeting, and the Approved Settlement, revised by ALJ Melanie Darling and Commissioner Michel Florio. Disclaimer: we make no warranty of accuracy and we reserve the right to change any position which may be stated here.| Deal Point | Warsaw Notes | Initial Settlement | Approved Settlement |

|---|---|---|---|

| Reference: | this page | Settlement Key Terms | Revised Decision |

| 1. Base Plant | Recover w/ debt-level through 2022 | Recover through 2022: Authorized Cost of Debt plus 50% of the Auth Cost of Preferred Stock, weighted by the amount of debt vs. stock in capital structure. SCE: 2012:2.95%; 2013-2014:2.62%; SDGE: 2012:2.75% 2013-14:2.35% | |

A4NR: {{Comments marked "A4NR" by John Geesman of the Alliance for Nuclear Responsibility. See the 2015-04-13 letter from John Geesman to the Assembly Committee on Utilities and Commerce, in "Related Documents"}} The Notes indicate Mr. Peevey would restrict return on the plant investment made prior to the Replacement Steam Generators to a "debt-level return" through 2022. The March 27, 2014 settlement proposal enriches this to include 50% of the cost of preferred stock. SCE's authorized capital structure in 2013 included 43% debt and 9% preferred stock. The effect of adding the preferred stock component into the March 27, 2014 settlement proposal likely increases the allowed return by 10.5%, assuming rates on debt and preferred stock average to be roughly equivalent over the 10 year period despite market fluctuations. Because of these fluctuations and the opacity of the present value calculation in the March 27, 2014 settlement proposal, I have not attempted any quantification of this increased return.

TURN {{Comments marked "TURN" by The Utility Reform Network, in their analysis attached in "Related Documents"}} The note calls for SCE and SDG&E to recover these costs at a “debt-level” return through 2022. The note refers to “debt-level” return for the entire amount of unrecovered plant investments (apart from the Replacement Steam Generators). The note does not specify when the base plant would be removed from rates (SCE and SDG&E had proposed June 1, 2013). By contrast, the proposed settlement removes base plant from rates on February 1, 2012 and provides zero return on the equity portion of the plant and only 50% of preferred returns on that portion of the plant investment. For SCE, a “debt-level” return for the unrecovered investment would be 7.64% while the settlement allows a return of 2.62%. For SDG&E, a “debt-level” return for the unrecovered investment would be 6.88% while the settlement provides a return of 2.41%.

(TURN also handles Nuclear Fuel, which was not explicitly included in the notes, as if it were returned in this same method. To do this implies they knew what the note included "Nuclear Fuel" in the base plant, and implies they may have had additional conversations to know this is what was meant by this first category in the note.)

TURN's Conclusion - The lower level returns included in the proposed settlement results in a reduction of over $200 million (Net Present Value) in ratepayer costs. If the note intended to remove base plant from rates later than February 1, 2012 (as proposed by SCE and SDG&E), the settlement would provide even larger reductions.

COPS response: This only points out that the definition of "Debt Level" is not really clear, and the debt level used for utilities is astronomical compared with all other businesses in the world right now, and is different from the definition used in the final settlement. This "drift" of terminology is a real problem that should not be allowed to continue!\

| 2. RSG and post-RSG investment | disallow "retroactively out of rate base" effective 2/1/2012 | (a) The Capital-Related Revenue Requirement for the SGRP will be terminated as of February 1, 2012. (b) The Utilities shall refund to ratepayers all amounts collected in rates as the Capital-Related Revenue Requirement for the SGRP for all periods on and after February 1, 2012. These amounts shall be refunded per the refund mechanism set forth in Section 4.12 of this Agreement. (c) The Utilities will retain all amounts collected in rates as the Capital-Related Revenue Requirements for the SGRP for periods prior to February 1, 2012. (d) The Utilities shall not recover in rates the Net Book Value of the SGRP as of February 1, 2012. |

|

| ANALYSIS - Warsaw note did not describe how funds disallowed would be distributed to ratepayers. The settlement proposes that instead of actual refunds, any refunds would be made to the ERRA (earned revenue requirement account) balancing account "refund mechanism" and would offset potential future increases. Such an arrangement does not attempt to refund current ratepayers but the set of ratepayers in the future, who are somewhat different. We note that this provision allows the utilities to retain amounts collected prior to the failure for the steam generators, which was about 20% of the total cost, even though the amount the generators were used so far was less than 4% of the advertised life. The problem with this notion is the fact that the steam generators were replaced earlier than necessary, as the original steam generators had not yet reached their plugging limit. Utility experts testified in the original approval of the project that they would have a 50/50 chance of reaching the plugging limit in 2016, so the project did not provide any net benefit to ratepayers as the original steam generators would have served the purpose. In other words, if no steam generator project had been approved, the plant would likely still be running on the old steam generators until 2016 A4NR: The Notes indicate Mr. Peevey would disallow the entire Replacement Steam Generator investment, while the March 27, 2014 settlement proposal allows recovery of $ 194 million collected in rates before February 1, 2012. Ratepayer bottom line: Peevey framework was more favorable by $194 million. TURN (Turn admits that this provision is the same as in the final settlement, and their lengthy analysis can be read in the source document, below.) |

|||

| 3. Replacement Power | responsibility: Customer | (a) The Utilities will recover in rates the full amount of any costs designated as SONGS “replacement power costs,” SONGS “replacement energy costs,” or “net SONGS costs” incurred to purchase power in the market from January 1, 2012, until the last day of the month prior to the Effective Date. [ there are additional provisions (b), (c), (d), which defines how the ERRA account will be amortized and how none of the settling parties can object to this recovery in the future. ] |

|

| ANALYSIS - If ratepayers are paying full freight for the O&M overhead of the plant, and for the net asset value of the plant, as proposed, it is double-dipping to also ask the ratepayers to fully pay for the replacement power. Our position is that ratepayers pay for nothing after Feb 1, 2012 except for replacement power. Also in the final settlement, replacement power is costs are added to an amortized amount so it is charged to ratepayers without being part of the ratemaking equation. | |||

| 4. NEIL / Insurance (Net Recovery) | 100% to customers | Net recoveries: 82.5%/17.5% ratepayers/utilities. | Net Recoveries: 95%/5% ratepayers/utility |

| ANALYSIS - The fundamental construct of all these deals is that the ratepayer largely covers losses of the plant up front, and then SCE attempts to get what they can from their insurance company NEIL and their subcontractor MHI, making the ratepayer the ultimate insurance company to cover their losses if the other insurance or their subcontractor does not work out. It also means that the ratepayer and the Commission assert that SCE was faultless in their execution of the RSG project, when in fact that proceeding was combined with the OII and then conveniently terminated, so no reasonableness review as ever conducted. Our position is that the split is 0%/100% customers/utilities, but we do not cover them up front (see Deal Point #1). This leaves the ratepayers out of their legal disputes and settles the case now, rather than later. A4NR: The Notes indicate Mr. Peevey would give ratepayers all of any recovery from the NEIL insurance, while the March 27, 2014 settlement proposal would provide the utilities with 17.5% of such recovery. Given the $409 million accidental outage claim identified in Edison's April 29, 2014 Form 10-Q, this is a $72 million difference. Because the settlement never identified an amount for the separate accidental property damage claim to be filed with NEIL, I have not attempted to value the 17.5% difference on it. Ratepayer bottom line: Peevey framework was more favorable by at least $72 million. |

|||

| 5. MHI Recovery (Net Recovery) | 1st to SCE to the extent of the allowance, 2d to customers (revised on the second page) 1) First $200 million: 50/50 customers/SCE 2) Next $200 million: 30/70 customers/SCE 3) > $400 million & < disallowance: 80/20 customers/SCE 4) > disallowance 75/25 customers/SCE |

1) First $100 million: 15/85 customers/SCE 2) Next $800 million: 33.33/66.67 customers/SCE 3) > $800 million: 75/25 customers/SCE |

1) First $282+$71 million: 0%/100% customers/SCE+SDG&E 2) > $353 million: 50/50 customers/utilities Recoveries to customers made by reducing base plant asset |

| ANALYSIS: Same comment as with the insurance. Our position is: no coverage of losses up front but utility can receive 100% of recovery from their legal dispute. Another big difference here is that ratepayers are not asked to pay for legal fees, and we do not have to wait many years for the cases to close to get our money. The change in the rate of recovery and simplification of the tiers is a small and insignificant change from the initial to the approved settlement, but did benefit ratepayers a bit. But the overall concept remains the same, cover their butts up front, and if they can get it covered by their insurance or litigation, they will share part of the recovery with ratepayers. We also note the astounding similarity in the concept of the tiers, even though the exact value of the tiers did change somewhat. The tiering concept was started by Peevey in the Warsaw Note and is essentially a fingerprint linking the note to the final settlement. A4NR: The Notes indicate Mr. Peevey would allow utility retention of any amounts recovered from MHI as follows: 50% of the first $200 million; 70% of the next $200 million; 80% of any additional recovery until the disallowance amount was met; and 25% of any recovery beyond that. The March 27, 2014 settlement proposal awarded the utilities 85% of the first $100 million; two-thirds of the next $800 million; and 25% of any recovery above $900 million. While it is extremely speculative to estimate whether there will be any recovery from MHI, Mr. Peevey's "framework" was $52 million more favorable to ratepayers for a $200 million recovery; $49 million more favorable for a $300 million recovery; $45 million more favorable for a $400 million recovery; and $33 million more favorable for a $500 million recovery. It is only in the hyper-optimistic scenario of a recovery from MHI approaching $700 million that the two approaches converge. Ratepayer bottom line: Peevey framework was more favorable by $33 - $52 million. TURN: Conclusion – The ultimate difference to ratepayers cannot be determined until NEIL coverage is successfully obtained, the arbitration proceedings between SCE and Mitsubishi are resolved, and the final amount of recoveries has been determined. |

|||

| 6. Decommissioning Costs | remain in rates through time of decommissioning -- periodic redetermination in CPUC Proceedings as before | This is not is the scope of the OII. However, current proceeding A.14-12-007, utilities recommend reducing ratepayer contributions to 0%, but this is still being processed | |

| ANALYSIS: This item was appropriately not part of the OII settlement as decommissioning funds are completely separate. TURN: The note assumes that all O&M costs after the shutdown of the plant would be paid through customer rates. In contrast, the settlement calls for SCE and SDG&E to recover their post-shutdown costs from the Nuclear Decommissioning Trusts, rather than ratepayers, whenever possible. Consistent with the settlement, SCE and SDG&E have pending requests to recover approximately $434 million from their nuclear decommissioning trust funds for O&M costs incurred between June of 2013 and December 31, 2014. If the CPUC approves these requests to access the trust funds, approximately $434 million would be returned to ratepayers. Conclusion – Under the settlement, ratepayers would receive approximately $434 million in refunds that are not contemplated under the note. COPS response: We disagree with this analysis. The note said that decommissioning would be handled in CPUC proceedings, and those are allowing the recapture of O&M costs, but those are all pending and are actually not part of the settlement. Again, splitting hairs to make the settlement look better than it is. |

|||

| 7. O&M | a) Already approved GRC amounts through shutdown + 6 months b) OII to determine shutdown O&M through end of 2017 (i.e. not in GRC) c) shutdown O&M 2018 and beyond determined in GRC's d) shutdown O&M to include reasonable severance for SONGS employees -- A pool of $50 million e) For 2012 non-O&M expenses, the utilities will be permitted to retain the provisionally authorized revenue requirement, except that the utilities shall refund revenues that exceed recorded non-O&M expenses by more than $10 million. |

a) 2012: Recover already approved GRC amounts SCE: No recovery of incremental steam generator inspection and repair ("SGIR") costs that exceed approved GRC amounts = $99 million. SDG&E: will recover recorded O&M expenses, resulting in a refund of approximately $5.1 million. b) 2013: utilities recover recorded O&M, SONGS-related severance expenses, incremental steam generator inspection and repair costs and non-O&M expenses, up to authorized, and refund amounts that exceed these recorded costs. c) 2014 costs are subject to future CPUC review, and the utilities will refund amounts collected in 2014 pursuant to provisionally authorized rates that exceed the utilities' recorded costs in 2014. d) To the extent the utilities recover costs from the Nuclear Decommissioning Trusts, the utilities will refund any rates collected that duplicate recoveries from the trusts. |

|

| ANALYSIS: The treatment of O&M (i.e. operating expenses) is largely the same between all the proposals, which is to allow the utilities to recover O&M from ratepayers. Our position is that it is not fair to have ratepayer both pay for the replacement power and for a plant that is not operating. Closure expenses are more appropriately derived from the decommissioning fund, but all the delays and struggle to restart unit 2, with no regard to cost, should not be underwritten by the ratepayer. A4NR: The Notes indicate that Mr. Peevey would restrict recovery of O&M to the amounts conditionally approved in the previous GRC through August 1, 2012. The March 27, 2014 settlement proposal expands O&M recovery to all of 2012 and 2013 with no reasonableness review, minus $126 million for the incremental Steam Generator Inspection and Repair costs. O&M for August 2012 thru December 2013 totaled $656 million. Ratepayer bottom line: Peevey framework was more favorable by $530 million. TURN The note calls for SCE and SDG&E to retain “O&M” (Operations and Maintenance) revenue requirements “already approved” in the most recent General Rate Cases (GRCs) “through shutdown + 6 months.” SONGS was permanently shutdown on June 12, 2013. Using the actual shutdown date, the note would allow recovery of previously authorized revenue requirements through the end of 2013. Had the note intended to reference the outage that began on January 31, 2012, it would have specified an actual date in 2012 (such as August 1, 2012) rather than stating “shutdown + 6 months” (which demonstrates that “shutdown” had not yet occurred at the time the note was drafted). For 2012, the settlement allows SCE and SDG&E to retain the lower of actual costs or GRC-authorized O&M revenue requirements. For 2013, the settlement requires SCE and SDG&E to refund the difference between authorized O&M revenue requirements and actual recorded costs. Actual O&M expenses were lower than GRC-authorized revenue requirements for SDG&E in 2012 (by $3.4 million) and 2013 ($23.5 million) and for SCE in 2013 (by $54 million). _TURN's Conclusion - The more favorable provision in the settlement results in a reduction of $80.9 million -- $54 million for SCE ratepayers and $26.9 million for SDG&E ratepayers._ COPS response: This demonstrates another term which can have two meanings, either actual plant shutdown, or the announcement of permanent shutdown nearly 1.5 years later. TURN is choosing the later date which makes their deal look better. |

|||

| 8. Environmental Offset: | SCE to donate $5.0 (no, $10) million per year 2014-2022 to __ {an agreed upon GHG, climate, or environmental academic research fund, institution, etc.} | Not in initial proposed settlement | SCE will pledge and donate $4 million annually for five years, and SDG&E will pledge and donate $1 million annually for five years, so that the total amounts donated will be $5 million annually for five years. All such donations will be from shareholder funds. |

A4NR: The Notes indicate that Mr. Peevey would demand SCE make an annual environmental mitigation contribution of $10 million for nine years from 2014 thru 2022. The March 27, 2014 settlement proposal is silent on this point. Ratepayer bottom line: Peevey framework was more favorable by $90 million.

TURN: The note calls for SCE to “donate” $90 million between 2014-2022 to an agreed-upon entity to perform research on greenhouse gases and climate change. The note does not indicate whether these funds would come from ratepayers or shareholders. The proposed settlement has no provisions addressing any such contributions. The CPUC issued a ruling modifying the settlement to require SCE and SDG&E to contribute $25 million over 5 years to the University of California for this purpose and specifying that shareholder money (not customer rates) is the source of these contributions. If the note contemplated that the $90 million would be funded through rates, the final settlement represents a savings of $90 million. If the note intended that the $90 million would come from shareholder fund, the impact on ratepayers would be the same under the note and the final settlement. _Conclusion – The settlement results in ratepayer savings of either $0 or $90 million depending on whether the note contemplated ratepayer-financed contributions._

COPS Says: The note consistently used the terms SCE to mean shareholders share and ratepayer to mean ratepayers share. This says SCE and it makes sense that this meant that shareholders would pay for it. Plus, since this was not in the settlement at all, and was added in by the Commission, it seems ridiculous that they would add this in incorrectly. |||

| 9. Process: | a) settlement agreement approved in OII b) balance of OII closed except for shutdown O&M phase c) new OII phase for shutdown O&M per 7(b) and 7(d) above d) 2018 GRC for shutdown O&M 2018 and beyond e) usual CPUC proceedings for review of decommissioning costs |

a) settlement agreement was approved in the OII b) balance of OII closed, including shutdown O&M phase [phase 1] c) new proceedings for shutdown O&M after 2013 (2014: A.15-01-014 and A.15-02-006) |

|

TURN The note calls for SONGS “shutdown” costs through 2017 to be decided in a new “shutdown O&M phase” of the CPUC SONGS OII with “shutdown O&M 2018 and beyond determined in [General Rate Cases]”. The settlement does not contain any similar provisions. Under the settlement, the SONGS OII is not continued for this purpose and “shutdown O&M” costs are not collected from customers. The settlement provides that costs relating to “shutdown O&M” are instead financed via decommissioning trust funds and directs the utilities to seek a determination as to the reasonableness of 2014 costs in a separate ongoing CPUC proceeding (A.14-12-007) that includes involvement from a wide range of active stakeholders. Conclusion – Under the settlement, all post-shutdown costs (beginning in June of 2013) are to be treated as decommissioning expenses and collected from decommissioning trust funds. For 2013-2014, this treatment results in approximately $434 million in refunds from the decommissioning trust funds. If the Note intended to allow collection of “shutdown O&M” in rates through 2018, the consequences for consumers would be significantly greater.

COPS responds: TURN assumes "shutdown O&M Phase" is a new phase while other readers have interpreted this to mean Phase 1 would be decided by the proceeding, while the other phases would be ignored by the settlement. Thus, by assuming that this is a new phase, nothing makes sense and the rest of TURNs analysis makes almost not sense. |||

Note: Not defined in Warsaw note: CWIP, Nuclear Fuel, Material and SuppliesA4NR: Significantly, the Notes make no mention of CWIP but the March 27, 2014 settlement proposal rolls CWIP into Base Plant. If the omission of CWIP in the Notes is logically interpreted to preclude recovery of CWIP which never went into service after February 1, 2012, the $919 --938 million difference identified above would be increased by $584 million. Ratepayer bottom line: Peevey framework was more favorable by $584 million. A 4 NR and TURN take opposite positions on the difference between the Hotel Bristol Notes to the March 27, 2014 settlement proposal. In this chart, we show how much improved for ratepayers the March 27, 2014 settlement proposal was compared with the hotel Bristol Notes. Positive values are improvements. Negative values are losses. Note: in some instances, the TURN document compares with the ultimate settlement rather than the settlement initially negotiated and released on March 27, 2014.

| Hotel Bristol Notes | A 4 NR | TURN |

|---|---|---|

| Base Plant: | No quantification | >$200 million |

| Nuclear Fuel | -- | <=$65 million |

| RSG disallowance: | ($194 million) | $0 - $189 million |

| NEIL insurance | (>= $72 million) | TBD |

| MHI recovery | ($33 — 52 million) | TBD |

| Excess O&M: | ($530 million) | $80.9 million |

| Use of Decom Funds | silent | $434 million |

| CO2 mitigation: | ($90 million) | ($0 - $90 million) |

| Excess CWIP | ($584 million) | silent |

| TOTAL: | ($1.503 — 1.522 billion) | $780 - 1,059 million |

Related Documents

- Settlement Key Terms (from March 27. 2014): Settlement Key Terms

- Revised Decision: Revised Decision

- I.12-10-013_Letter_to_Assembly_Utilities_and_Commerce_Committee_from_Geesman_quantifying_Peevey_vs_ORA-TURN_difference.pdf: Geesman Letter to Assembly Utilities and Commerce Committee quantifying Peevey vs ORA-TURN difference.pdf

- TURN_Comparison_final_April17.pdf: TURN's comparison of the Hotel Bristol Notes and the Settlement, claiming the settlement was an improvement.

Media Form edit

| Title | RSG Notes on Hotel Bristol Stationery |

| Publisher | Citizens Oversight |

| Author | Michael Peevey, Stephen Pickett |

| Pub Date | 2013-03-26 |

| Media Link | |

| Embed HTML | |

| Forum Link | |

| Note | Received on 2015-04-10 |

| Keywords | California Public Utilities Commission, Energy Policy, Shutdown Diablo, Shut San Onofre, Stop The Unfair Settlement |

| Media Type | |

| Media Group | News |

| Curator Rating | Plain |

| Book ISBN | |

| Author Name Sortable | |

| Thumbnail Link |

| I | Attachment | Action | Size | Date | Who | Comment |

|---|---|---|---|---|---|---|

| |

1.png | manage | 437 K | 11 Apr 2015 - 02:51 | Raymond Lutz | Hotel Bristol Notes, Page 1 |

| |

2.png | manage | 408 K | 11 Apr 2015 - 02:52 | Raymond Lutz | Hotel Bristol Notes, Page 2 |

| |

Hotel_Bristol_Notes.pdf | manage | 741 K | 11 Apr 2015 - 02:45 | Raymond Lutz | PDF of RSG Notes on Hotel Bristol Stationery |

| |

I.12-10-013_Letter_to_Assembly_Utilities_and_Commerce_Committee_from_Geesman_quantifying_Peevey_vs_ORA-TURN_difference.pdf | manage | 156 K | 13 Apr 2015 - 17:41 | Raymond Lutz | Geesman Letter to Assembly Utilities and Commerce Committee quantifying Peevey vs ORA-TURN difference.pdf |

| |

TURN_Comparison_final_April17.pdf | manage | 93 K | 18 Apr 2015 - 02:06 | Raymond Lutz | TURN's comparison of the Hotel Bristol Notes and the Settlement, claiming the settlement was an improvement. |

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors. Ideas, requests, problems regarding Cops? Send feedback